Sahana Satish is Zerodha Authorised Partner Based out of Bangalore. She is passionate about Financial Markets and Investor behaviour.

She writes about IPOs and other investment avenues regularly.

You can also join her FREE Whatsapp group where she shares IPO Updates and knowledge regularly.

Click on below Icon to Join the Whatsapp group. (No Stock tips/advice etc are provided. It is purely for knowledge sharing; Not SEBI Registered)

Indegene IPO Overview

You are at right place to check all the details regarding Indegene IPO. The dates for Indegene IPO is announced. The IPO will open on May 6, 2024 and will close on May 8, 2024 .

The Indegene IPO price band is fixed at ₹430 to ₹452 Per Share. The company aims to to raise around ₹1841.76 Crores via this IPO. You can find complete information about Indegene IPO in this post.

The Indegene IPO lot size for the application is 33 shares and hence minimum amount that you would need for this IPO (by retail investors) is ₹14,916.

About Indegene IPO:

Indegene provides digital-led commercialization services for the life sciences industry, including biopharmaceutical, emerging biotech, and medical devices companies, that assist them with drug development and clinical trials, regulatory submissions, pharmacovigilance and complaints management, and the sales and marketing of their products. Their solutions enable life sciences companies to develop products, launch them in the market, and drive sales through their life cycle in a more effective, efficient, and modern manner.

They achieve this by combining over two decades of healthcare domain expertise and fit-forpurpose technology. Their portfolio of solutions covers all aspects of commercial, medical, regulatory, and R&D operations of life sciences companies.

They have established client relationships with each of the 20 largest biopharmaceutical companies in the world by revenue for the Financial Year 2023 (Source: Everest Report), having earned more than 69.00% of their total revenue from operations for each of the nine months ended December 31, 2023, and 2022 and the Financial Years 2023, 2022 and 2021 from these 20 customers.

As of December 31, 2023, they had a total of 65 active clients (i.e., clients from whom they earned US$0.25 million or more in revenues during the 12 months preceding the relevant date). They had 27 clients from whom they earned between US$1 million and US$10 million in revenues, five clients from whom they earned between US$10 million and US$25 million in revenues, and three clients from whom they earned more than US$25 million in revenues, during the 12 months ended December 31, 2023.

Objects of the Issue

- Repayment/prepayment of indebtedness of one of our Material Subsidiaries, ILSL Holdings, Inc

- Funding the capital expenditure requirements of our Company and one of our Material Subsidiaries, Indegene Inc

- General corporate purposes and inorganic growth.

Indegene IPO Review (Apply or Not?)

To be updated

Indegene IPO Brokrage House Reviews:

- Capital Market: To be updated soon

- Religare Broking: To be updated soon

- Hem Securities: To be updated soon

- Arihant Capital: To be updated soon

Indegene IPO Date & Price Band Details

| IPO Open: | May 6, 2024 |

| IPO Close: | May 8, 2024 |

| IPO Size: | ₹1841.76 Crores |

| Fresh Issue: | ₹760 Crores (Approx) |

| Offer For Sale | Approx ₹1081.76 Crores, 2,39,32,732 Equity shares |

| Face Value: | Rs2 Per Equity Share |

| IPO Price Band: | ₹430 to ₹452 Per Share |

| IPO Lot Size | 33 Shares |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 35% |

| QIB Quota: | 50% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

Indegene IPO Market Lot

The Indegene IPO minimum market lot is 33 shares which is equal to ₹14,916 application amount. The retail investors can apply up-to 13 lots with 429 shares which is equal to ₹193,908

| Category | Lot Size | Shares | Required Amount |

| Retail Minimum | 1 | 33 | ₹14,916 |

| Retail Maximum | 13 | 429 | ₹193,908 |

| S-HNI Minimum | 14 | 462 | ₹208,824 |

| B-HNI Minimum | 68 | 2,244 | ₹1,014,288 |

Indegene IPO Allotment & Listing Dates

The Indegene IPO open date is May 6, 2024 and the close date is May 8, 2024 . The Indegene IPO allotment will be finalized on May 9, 2024 and the IPO listing on May 13, 2024 .

| IPO Open Date: | May 6, 2024 |

| IPO Close Date: | May 8, 2024 |

| Basis of Allotment: | May 9, 2024 |

| Refunds: | May 10, 2024 |

| Credit to Demat Account: | May 10, 2024 |

| IPO Listing Date: | May 13, 2024 |

Indegene Company Financial Report

| Year | Revenue (Cr) | Expense (Cr) | PAT (Cr) |

| 2021 | ₹996.92 | ₹768.25 | ₹149.41 |

| 2022 | ₹1690.50 | ₹1417.10 | ₹162.82 |

| 2023 | ₹2364.10 | ₹2001.05 | ₹266.10 |

Indegene IPO Valuation

Below is the financial details of Indegene for the year FY2023.

| Earning Per Share (EPS): | ₹12.03 per Equity Share |

| P/E Ratio: | – |

| Return on Net Worth (RoNW): | 25.02% |

| Debt/Equity: | ₹48.10 per Equity Share |

Company Promoters:

- NA

Competitor Companies:

- The company is a professionally managed company and does not have an identifiable promoter.

Indegene IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: indegene.ipo@linkintime.co.in

Website: https://linkintime.co.in/

Indegene IPO Lead Managers

- Kotak Mahindra Capital Company Limited

- Citigroup Global Markets India Private Limited

- J.P. Morgan India Private Limited

- Nomura Financial Advisory and Securities (India) Private Limited

Indegene IPO Allotment Status Check

Allotment status of Indegene IPO can be checked on Linkintime website : Click here

Company Address of Indegene :

Indegene Limited

Aspen Block G4, 3rd Floor, Manyata Embassy Business Park,

Outer Ring Road, Nagawara, Bengaluru 560 045, Karnataka

Phone: +91 80 4674 4567

Email: compliance.officer@indegene.com

Website: www.indegene.com

Indegene IPO FAQs

Q1) What is Indegene IPO?

Answer: Indegene IPO is Initial Public Offer from Indegene company. The company is planning to raise ₹1841.76 Crores via this IPO. The share price is priced at band of ₹430 to ₹452 per equity share. The IPO will be listed on BSE & NSE.

Q2) When Indegene IPO will open and close?

Answer: The IPO is to open on May 6, 2024 for QIB, NII, and Retail Investors and closes on 8 May, 2024

Q3) What is Indegene IPO Investors Portion?

Answer: The investors’ portion for QIB is 50%, NII is 15%, and Retail is 35%.

Q4) What is the Indegene IPO Allotment Date?

Answer: Indegene IPO allotment date is May 9, 2024.

Q5) What is the Indegene IPO Listing Date?

Answer: Indegene IPO listing date is May13, 2024. The IPO is to list on BSE and NSE.

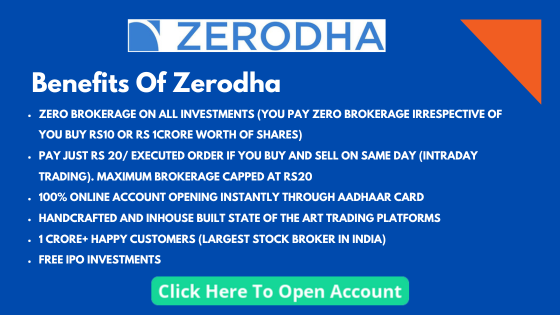

Q6) How to Apply the Indegene IPO through Zerodha?

Answer: You can apply to this IPO through Zerodha by logging in to Console in Zerodha Website. Go to Portfolio and Click on IPO. You will see the IPO Name “Indegene ”. Click on Bid Button. Enter your UPI ID, Quantity, and Price. Submit IPO Application Form. Now go to your UPI App like PhonePe or GooglePay etc to Approve the mandate. If you still dont have Demat account with Zerodha you can open it using this link, Open Demat Account with Zerodha.