Sahana Satish is Zerodha Authorised Partner Based out of Bangalore. She is passionate about Financial Markets and Investor behaviour.

She writes about IPOs and other investment avenues regularly.

You can also join her FREE Whatsapp group where she shares IPO Updates and knowledge regularly.

Click on below Icon to Join the Whatsapp group. (No Stock tips/advice etc are provided. It is purely for knowledge sharing; Not SEBI Registered)

Ixigo IPO Overview

You are at right place to check all the details regarding Ixigo IPO. The dates for Ixigo IPO is announced. The IPO will open on June 10, 2024 and will close on June 12, 2024

The Ixigo IPO price band is fixed at ₹88 to ₹93 Per Share. The company aims to to raise around ₹740.10 Crores via this IPO. You can find complete information about Ixigo IPO in this post.

The Ixigo IPO lot size for the application is 33 shares and hence minimum amount that you would need for this IPO (by retail investors) is ₹14,973.

About Ixigo IPO:

Le Travenues Technology Ltd (Ixigo) is a technology company focused on empowering Indian travelers to plan, book, and manage their trips across rail, air, buses, and hotels. They assist travelers in making smarter travel decisions by leveraging artificial intelligence, machine learning, and data science-led innovations on their OTA platforms, comprising their websites and mobile applications. Their vision is to become the most customer-eccentric travel company, by offering the best customer experience to their users. Their focus on travel utility and customer experience for travelers in the ‘next billion user’ market segment is driven by technology, cost-efficiency, and their culture of innovation.

Their OTA platforms allow travelers to book train tickets, flight tickets, bus tickets, and hotels while providing travel utility tools and services developed using in-house proprietary algorithms and crowd-sourced information, including train PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, alternate route or mode planning, flight status updates, automated web check-in, bus running status, pricing and availability alerts, deal discovery, destination content, personalized recommendations, instant fare alerts for flights, AI-based travel itinerary planner and automated customer support services.

Ixigo has significant penetration in the ‘next billion user’ market. ‘Next billion users’ refers to an existing as well as anticipated market of “new to Internet” users that includes all non-Tier I market demand i.e., all travel demand originating from and/or concluding in Tier II, III and rural areas in India as well as “new to Internet” users emerging from middle and lower income groups of Tier I cities. (Source: F&S Report)In the next five years, it is expected that 20% of the ‘next billion users’ will come from Tier I cities, and a substantial 50% to come from Tier II and Tier III cities, and significantly, the rest of 30% will come from rural India. (Source: F&S Report)

Objects of the Issue

- Part- funding working capital requirements of our Company.

- Investments in cloud infrastructure and technology.

- Funding inorganic growth through unidentified acquisitions and other strategic initiatives and general corporate purposes.

Ixigo IPO Review (Apply or Not?)

- Apply

Ixigo IPO Brokerage House Reviews:

- Ajcon Global Services: Apply

- Anand Rathi: Apply

- BP Equities (BP Wealth): Apply

- Canara Bank Securities: Apply

- SBICAP Securities: Apply

- SMC Global: Neutral

- Swastika Investmart: Apply

- Ventura Securities: Apply

Ixigo IPO Date & Price Band Details

| IPO Open: | June 10, 2024 |

| IPO Close: | June 12, 2024 |

| IPO Size: | Approx ₹740.10 Crores, 79,580,900 Equity Share |

| Fresh Issue: | Approx ₹120 Crores, 12,903,226 Equity Share |

| Offer For Sale | Approx ₹620.10 Crores, 66,677,674 Equity Share |

| Face Value: | Rs1 Per Equity Share |

| IPO Price Band: | ₹88 to ₹93 Per Share |

| IPO Lot Size | 161 Shares |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 10% |

| QIB Quota: | 75% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

Ixigo IPO Market Lot

The Ixigo IPO minimum market lot is 161 shares which is equal to ₹14,973 application amount. The retail investors can apply up-to 13 lots with 2093 shares which is equal to ₹194,649

| Category | Lot Size | Shares | Required Amount |

| Retail Minimum | 1 | 161 | ₹14,973 |

| Retail Maximum | 13 | 2093 | ₹194,649 |

| S-HNI Minimum | 14 | 2254 | ₹209,622 |

| B-HNI Minimum | 67 | 10787 | ₹1,003,191 |

Ixigo IPO Allotment & Listing Dates

The Ixigo IPO open date is June 10, 2024 and the close date is June 12, 2024 . The Ixigo IPO allotment will be finalized on June 13, 2024 and the IPO listing on June 18, 2024 .

| IPO Open Date: | June 10, 2024 |

| IPO Close Date: | June 12, 2024 |

| Basis of Allotment: | June 13, 2024 |

| Refunds: | June 14, 2024 |

| Credit to Demat Account: | June 14, 2024 |

| IPO Listing Date: | June 18, 2024 |

Ixigo Company Financial Report

| Year | Revenue (Cr) | Expense (Cr) | PAT (Cr) |

| 2021 | ₹138.40 | ₹135.70 | ₹7.53 |

| 2022 | ₹384.94 | ₹402.54 | -₹21.09 |

| 2023 | ₹517.57 | ₹484.29 | ₹23.40 |

Ixigo IPO Valuation

Below is the financial details of Ixigo for the year FY2023.

| Earning Per Share (EPS): | ₹0.58 per Equity Shar |

| P/E Ratio: | – |

| Return on Net Worth (RoNW): | 5.74% |

| Debt/Equity: | ₹11.43 per Equity Share |

Company Promoters:

- The Company is a Professionally Managed Company and Does Not Have an Identifiable Promoter

Competitor Companies:

- Easy Trip Planners Limited

- Yatra Online Limited

Ixigo IPO Registrar

Link Intime India Private Ltd

E-mail: ixigo.ipo@linkintime.co.in

Phone:(+91) 81081 14949

Website: https://linkintime.co.in/

Ixigo IPO Lead Managers

- DAM Capital Advisors Limited

- Axis Capital Limited

- JM Financial Limited

Ixigo IPO Allotment Status Check

Allotment status of Ixigo IPO can be checked on Linkintime website : Click here

Company Address of Ixigo :

Le Travenues Technology Limited

Second Floor, Veritas Building, Sector -53

Golf Course Road, Gurugram 122 002, Haryana, India

Phone: (+91 124) 668 2111

E-mail: investors@ixigo.com

Website: www.ixigo.com

Ixigo IPO FAQs

Q1) What is Ixigo IPO?

Answer: Ixigo IPO is Initial Public Offer from Ixigo company. The company is planning to raise ₹740.10 Crores via this IPO. The share price is priced at band of ₹88 to ₹93 per equity share. The IPO will be listed on BSE & NSE.

Q2) When Ixigo IPO will open and close?

Answer: The IPO is to open on June 10, 2024 for QIB, NII, and Retail Investors and closes on June 12, 2024

Q3) What is Ixigo IPO Investors Portion?

Answer: The investors’ portion for QIB is 50%, NII is 15%, and Retail is 35%.

Q4) What is the Ixigo IPO Allotment Date?

Answer: Ixigo IPO allotment date is June 13, 2024.

Q5) What is the Ixigo IPO Listing Date?

Answer: Ixigo IPO listing date is June 18, 2024. The IPO is to list on BSE and NSE.

Q6) How to Check 3C IT Solutions IPO Grey Market Premium (GMP)?

Answer: The IPO GMP can be checked by visiting Ixigo IPO Premium page. Alternatively it can also checked along with GMP of other IPOs at IPO Grey Market Page.

Q6) How to Check 3C IT Solutions IPO Allotment Status?

Answer: The IPO Allotment can be checked by visiting Ixigo IPO allotment status page. Alternatively, it can also checked along with allotment status of other IPOs at IPO Allotment Status Page.

Q7) How to Check 3C IT Solutions IPO Subscription Status?

Answer: The IPO Subscription can be checked by visiting Ixigo IPO Subscription status page. Alternatively, it can also checked along with subscription status of other IPOs at IPO Subscription Status Page.

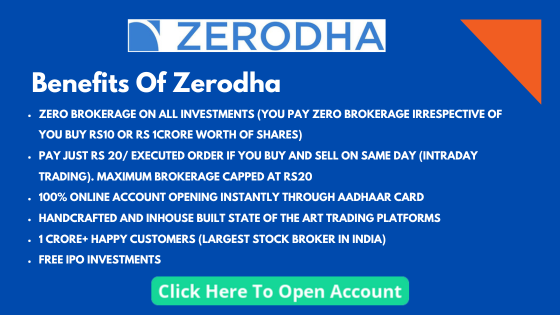

Q8) How to Apply the Ixigo IPO through Zerodha?

Answer: You can apply to this IPO through Zerodha by logging in to Console in Zerodha Website. Go to Portfolio and Click on IPO. You will see the IPO Name “Ixigo ”. Click on Bid Button. Enter your UPI ID, Quantity, and Price. Submit IPO Application Form. Now go to your UPI App like PhonePe or GooglePay etc to Approve the mandate. If you still dont have Demat account with Zerodha you can open it using this link, Open Demat Account with Zerodha.